Director Operaciones América

A few weeks ago a customer asked us to explain how the three big clouds were positioned in the world of agriculture. It really is not an easy question to answer, but I will try to summarise some elements that, from my experience, are relevant to the application status of the latest data technologies in the sector. This is a sector in which the coronavirus pandemic and its impact on the shortage of workers has led to increased interest in investment in robotics and automation.

Throughout the agri-food market value chain there are really endless solutions for applying advanced analytics technologies, starting with solutions close to the end customer under the umbrella of CRM and Social Marketing, through solutions for automation of production processes under ERP and the robotisation of operations and, of course, solutions for the whole logistics chain in the SCM field, from optimisation of routes to optimisation of warehoused assets. But perhaps less well-known and more specific to agriculture are those solutions close to the initial processes in crops and the production of raw material for food.

This market has probably been reluctant to implement substantial digital transformation projects, therefore marginal for big players, due to the great spread of producers and their limited coordination in public initiatives. But even so, relevant brands such as Syngenta, DJI, Slantrange and John Deere are now unquestionable examples of the application of the latest data and analytics technologies in the industry.

In the production phases, the combination of sensors, drones, image recognition, thermography and spectrography, autonomous vehicles and biotechnology have achieved further increases in production capacities and drastic reductions in labour, chemical consumables and water use.

Today, in addition to advances in weather forecasting systems, GPS systems and satellite photography, drones are one of the areas seeing most development. These platforms provide detailed information on hydrological status, crop ripening and plant health status. The cameras that drone platforms such as DJI now carry enable from surveying three-dimensional geometries of the ground to accurately identifying to centimetre precision where to apply water or plant protection products and to the most suitable time for harvesting each square metre. All this via services available on cloud platforms, using available algorithms capable of identifying crop numbers and sizes or specific pests and their location.

These are technologies where massive image processing (graphics, thermal or spectrographic images) and pattern identification are key elements.

The great evolution products of chemical or biological origin are undergoing is not to be forgotten. Syngenta, which leads in production of fertilisers, seeds and plant protection products, annually promotes its Crop Challenge in Analytics, where it presents awards to analytical projects worldwide for development of efficient and sustainable systems.

A key feature of this sector are the marketplaces; in addition to the integrated cloud solutions that process images, deliver results and generate the decisions that come with them, these marketplaces also provide the parametrisable algorithms and models to apply them to your data. Slantrange internationally and Hemav in Spain are benchmarks for these integrated cloud platforms. And platforms such as Keras and Caffe avoid the need to beat your brains developing algorithms. You simply need to find the most suitable ones, parametrise them for your data set and make them compete with one another to find the most efficient. New models are emerging at Open AI every 18 months.

Another fundamental element is the open data platforms, from meteorological, satellite or geological to historical data in certain geographical areas. Crossing these with your own data enables from improved prediction of weather phenomena and their impact on crop ripening to predicting future crop volume and its value on the market.

Another fundamental element is the open data platforms, from meteorological, satellite or geological to historical data in certain geographical areas. Crossing these with your own data enables from improved prediction of weather phenomena and their impact on crop ripening to predicting future crop volume and its value on the market.

Finally, a differentiating element is the self-driving vehicles from companies such as John Deere, which manufactures tractors that use the same artificial intelligence models as used in self-driving cars as sophisticated as Alphabet’s Waymo. Image recognition models allow for positioning and measurement actions that reduce herbicide or fertiliser applications by 70 to 90%. It should be noted that approximately 50% of fertilisers are lost to the environment under normal conditions.

Finally, a differentiating element is the self-driving vehicles from companies such as John Deere, which manufactures tractors that use the same artificial intelligence models as used in self-driving cars as sophisticated as Alphabet’s Waymo. Image recognition models allow for positioning and measurement actions that reduce herbicide or fertiliser applications by 70 to 90%. It should be noted that approximately 50% of fertilisers are lost to the environment under normal conditions.

In this context, the magazine 360 Market Updates identifies, in its 2020 report for the market it calls “Global Connected Agriculture”, expected CAGR growth of 17.08% during the 2020-2024 period. And the big players are not oblivious to this view.

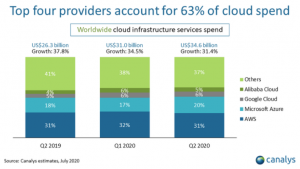

Attempting to discriminate the main players in cloud services, Google GCP, Amazon AWS and Microsoft Azure are now the distinct leaders in both infrastructure and in analytics or BI platforms, according to Gartner. But it is difficult to identify the most suitable for a generic requirement, even by dropping to a preliminary level of detail.

In our analysis of the three platforms in which we have assessed core extraction, integration, and governance capabilities, we conclude that all three have services capable of providing equivalent coverage. Obviously the pricing policies of all of them are adapted to the requirements of each situation under the same terms of competitiveness.

However, coming down to the level of solutions for the agri-food sector, it is AWS and Azure which have developed specific approximation models. They have both developed integration platforms for IoT solutions, integrated services for information dumping from all types of sensors, devices or machines, and enabled services to do so by both streaming and by batch.

Both AWS and Azure have partners that support the extraction processes of these IoT platforms and ensure communications and data capture. But perhaps Microsoft has gone a step further by investing in partners with specific end-to-end solutions in the segment, which are differential in the market. One example of this is Slantrange, which covers the entire process that drones perform, from the generation of flight plans to the processing of both thermal and thermographic images and their exploitation for decision-making by farmers. And along the same lines, Microsoft has reached agreements with market-leading drone platforms, such as DJI and AirMap, and has developed a 3D Drone Flight Simulator. This entire strategy, focused on the source link of the business chain, provides an additional step for data preparation prior to processing on its artificial intelligence platforms.

The Azure FarmBeats service enables creation of a specialised space for the farmer where drone or satellite image processing capabilities are integrated, as well as analysis algorithms for decision-making on crops.

At Bluetab we see how the three platforms’ services are currently undergoing extraordinary evolution and all three have entered a fierce race to ensure that they are matching up to the services of their closest competitors. Any of the so-called “killer applications”, such as Kubernetes or kafka, are now available on all three and they allow for previously unthinkable levels of service integration. Therefore, in the analysis for the decision on the Platform, other important decision variables also need to be included, such as the level of implementation of the Platform in your local market and the availability of trained resources, integration with your current on-premises platforms or the commercial policies of each.

We could say in general terms that the AWS platform currently leads its competitors in terms of market position, although it has seen a small drop in its position in the last year. And this means that, in markets such Spain and Mexico, our perception is that the number of resources available is also greater.

We could say in general terms that the AWS platform currently leads its competitors in terms of market position, although it has seen a small drop in its position in the last year. And this means that, in markets such Spain and Mexico, our perception is that the number of resources available is also greater.

However, it is clear that the pre-existing level of Microsoft solutions in the corporate market and the integration facilities of its entire Office platform, with specific solutions such as Power BI, mean that users’ affinity position Azure as the most sought-after alternative solution. Power BI is currently one of three leading operating platforms, together with Tableau and Qlik.

On the other hand, Google, with GCP, focuses its strategy on its specific artificial intelligence and machine learning solutions, such as its natural language or image recognition solutions and its TensorFlow platforms. All this is supported by integration with its well-known service platforms, such as Maps and Ads. And this means that its third player position is becoming more secure.

Finally, there are two additional points to consider. The first is that the multi-cloud concept is increasingly becoming a reality and tools such as VM Ware enable integrated management solutions for coexistence of different solutions with different clouds. Therefore, and this is the second point, the specific requirements of each service need to be evaluated to assess whether any of them have a higher level of development. So, for example, in terms of gaming platforms, Microsoft would appear to be the leader with its XBox, but now Lumberyard, the video games engine, and Twitch, both of AWS, and Google Stream are coming up strong. And as in this, the three competitors reposition themselves in all segments within a few months, so the differentiating windows are sometimes marginal.

An exciting market, where the three platforms – AWS GCP and Azure – make access increasingly difficult for others such as Alibaba, IBM and other competitors, and sink deeper into their position, generating actual oligopolies… but that complex matter will be addressed on another occasion.

Currently Bluetab COO for America, he has developed his professional career in various international management positions in sales and consulting areas in companies such as IBM, BT and Bankinter. He has also led entrepreneurship initiatives such as JC Consulting Ass. in technology consulting and Gisdron, a drone services start-up. He is an Architect specialising in structural calculation and has been trained in graduate schools such as IESE, INSEAD and TEC of Monterrey, Mexico.